RM Elon Musk’s Tax Shock: How His $12 Billion Bill ‘Broke’ the IRS

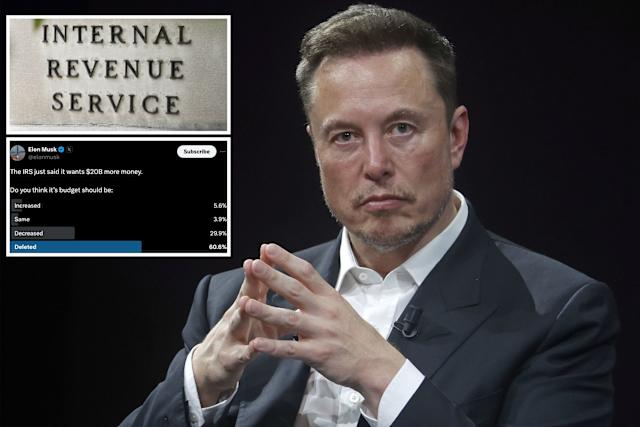

Elon Musk, the world’s richest individual with a net worth surpassing $600 billion, has made headlines recently with a statement about his hefty tax payments. On social media platform X (which he owns), Musk humorously shared that he once paid so much in taxes that it “broke the IRS computer”—a claim he said was literal, due to the overwhelming number of digits in the tax amount.

Musk’s wealth, primarily tied to stock in the companies he leads rather than salary, leads to unpredictable and sometimes enormous tax bills. This is because his vast fortune mostly exists in the form of “paper wealth,” locked in his shares in companies like Tesla and SpaceX. Therefore, his taxes can fluctuate significantly based on the year’s stock transactions.

For example, between 2014 and 2018, Musk paid around $455 million in taxes on approximately $1.52 billion of reported income. However, in 2018, he paid zero federal income tax, largely due to losses, tax deductions, and the way U.S. tax laws treat unrealized gains.

Musk’s largest tax burden came in 2021, after he sold around $14 billion worth of Tesla stock. This sale, triggered by stock options, converted his paper wealth into actual income, resulting in an estimated tax bill of $12 billion. The sale made a significant impact on his financial situation, reflecting the unpredictable nature of billionaire taxes.

Despite his vast wealth, Musk often describes himself as “cash poor,” explaining that much of his fortune is tied up in ventures aimed at long-term goals, like advancing humanity’s exploration of space. He has even pledged to sell most of his personal possessions, focusing on investments that support his vision for the future.

A key turning point in his financial journey occurred when the Delaware Supreme Court reinstated his 2018 Tesla compensation package. This ruling reversed a previous decision that had voided the deal, resulting in stock options worth far more than originally anticipated. This move pushed Musk’s net worth even higher, reinforcing his position as the wealthiest person on the planet.

Beyond his work with Tesla and SpaceX, Musk controls a vast array of other companies, including Neuralink, The Boring Company, X Corp. (formerly Twitter), and xAI. These ventures contribute to both his immense fortune and the unpredictable nature of his tax liabilities.

Ultimately, Musk’s comment about “breaking” the IRS highlights a broader truth about the financial world of modern billionaires: large, sudden tax obligations are inevitable when paper wealth becomes real income.