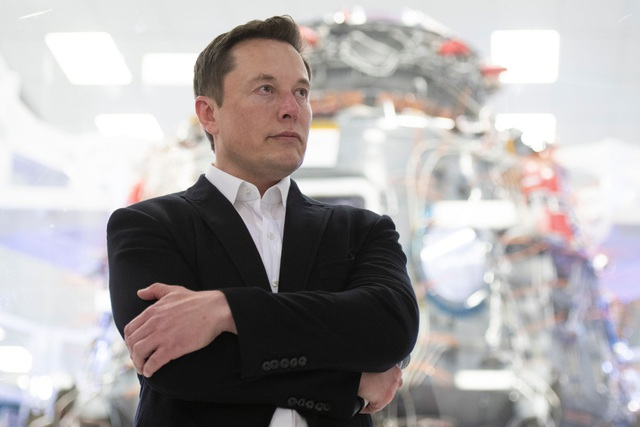

RM Elon Musk Preparing for a Trillion-Dollar ‘Bombshell’ IPO with SpaceX

Billionaire Elon Musk is reportedly gearing up for one of the largest Initial Public Offerings (IPOs) in history with his space exploration company, SpaceX. According to Bloomberg, the IPO could potentially value the company at a staggering $1.5 trillion, a move that could significantly boost Musk’s already substantial fortune.

SpaceX’s Ambitious Plans

Musk’s aerospace company is looking to raise $30 billion next year through this IPO. Despite being a private company so far, SpaceX has never struggled to secure funding. The public offering will provide an additional stream of cash flow, which is crucial for fueling the company’s ambitious and expensive goals.

Although SpaceX is still privately held, it has already attracted major investors, including Alphabet (Google’s parent company), Fidelity Investments, and renowned venture capital firms such as Founders Fund, Sequoia Capital, Valor Equity Partners, and Andreessen Horowitz. As of now, SpaceX has raised approximately $10 billion in funding, and each fundraising round has garnered significant interest from investors.

Musk’s Growing Wealth

Elon Musk, the world’s richest person, is set to get even wealthier from this IPO. With a personal net worth of $461 billion, largely due to his Tesla stock, Musk owns nearly half of SpaceX, meaning a successful IPO could potentially double his fortune. The IPO will also allow Musk to leverage his shares in SpaceX for loans, providing a “tax-free” source of cash to fund other projects, much like he has done with his Tesla stock.

A Game-Changer for SpaceX

SpaceX is at a pivotal moment in its journey. The company is nearing total dominance in the satellite launch market and has been instrumental in sending astronauts to space. The upcoming IPO will offer the company’s early investors an opportunity to realize significant returns on their investments.

Moreover, SpaceX’s Starlink satellite network has turned the company into a major global internet service provider. The influx of capital from the IPO will help SpaceX pursue even more ambitious goals, such as expanding Starlink’s reach and continuing its high-profile contracts with NASA, including missions to supply the International Space Station and send astronauts to the Moon.

The Risks of Going Public

However, the IPO is not without risks. Investors acknowledge that it may place pressure on Musk to focus on short-term profits rather than long-term objectives. This could conflict with SpaceX’s high-risk, high-reward ambitions, which often involve substantial upfront costs before seeing returns.

Furthermore, going public will subject SpaceX to increased scrutiny from regulators, such as the U.S. Securities and Exchange Commission (SEC). Musk has had a contentious relationship with the SEC, particularly after a 2018 incident where he attempted to take Tesla private, only to abandon the plan later.

The Bigger Picture: Global Economic Implications

The global economy is interconnected, and developments in the U.S. tech industry, like SpaceX’s IPO, have far-reaching effects. In countries with open economies like Vietnam, these trends cannot be ignored. Understanding global business trends and keeping up with the latest economic developments is essential for businesses everywhere. Through its ongoing coverage, Znews’ Global Economics Library offers a wide range of insights into global economic activities, from the rise of major corporations to emerging economic trends that could shape the future of international business.

The Future of SpaceX and Beyond

With its combination of cutting-edge technology, lucrative government contracts, and a revolutionary internet service in Starlink, SpaceX is poised to take on even more ambitious projects. However, Musk will have to balance his long-term vision with the demands of public shareholders—something that could change the course of both his personal wealth and the future of space exploration.