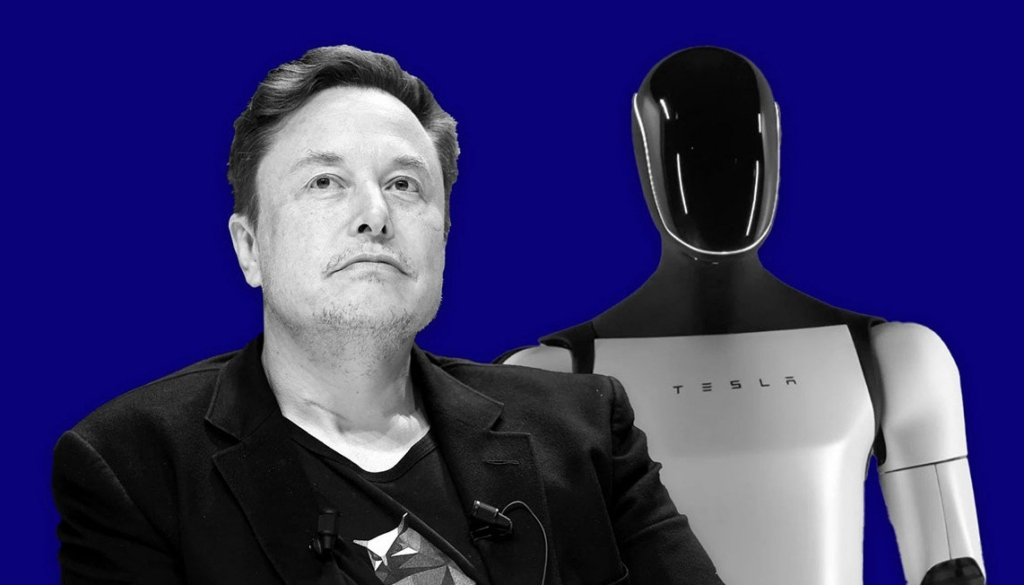

RM Elon Musk Seeks Trillion-Dollar Pay Deal to Fund Tesla “Robot Army” as Shareholder Backlash Grows

Tesla CEO Elon Musk is facing mounting resistance over a proposed compensation package that could be worth as much as $1 trillion, after he told investors the money is necessary to build what he described as a massive “robot army.”

The controversy intensified during Tesla’s quarterly earnings call on October 22, when Musk said he would need significant control over the company to feel secure developing large-scale humanoid robotics through Tesla’s Optimus project. Under the proposal, Musk would receive Tesla stock tied to ambitious performance targets over the next decade, along with increased voting power on the company’s board — potentially close to 25 percent.

Musk framed the issue as one of control and stability. He told investors he would not feel comfortable creating powerful AI-driven robots if he could later be removed from leadership. During the same call, he also claimed Optimus could eventually perform highly skilled tasks, even suggesting it could function as a surgeon.

Investors, however, appeared unconvinced. Wall Street analysts were focused on Tesla’s declining electric vehicle sales, not speculative robotics projects, and the company’s stock dropped immediately following the call.

Public skepticism toward powerful tech billionaires and artificial intelligence has further fueled opposition to Musk’s proposal. A coalition known as the Take Back Tesla campaign — made up of labor unions and corporate accountability groups — is urging shareholders to vote against the compensation plan at Tesla’s upcoming November 6 shareholder meeting. If approved, the deal would surpass all previous executive pay packages in corporate history.

Randi Weingarten, president of the American Federation of Teachers, criticized Tesla’s board for what she called a failure of corporate governance. She urged state pension fund managers to oppose the package, arguing that Musk has been more focused on political conflicts than creating value for shareholders.

The campaign also points to Musk’s political activity as damaging to Tesla’s brand. His involvement with far-right politics, including his role in the so-called Department of Government Efficiency (DOGE) during President Donald Trump’s administration, is cited as a major factor behind declining Tesla sales. Critics say Musk’s actions alienated customers and harmed the company’s reputation.

Emma Ruby-Sachs, executive director of the watchdog group Ekō, argued that no executive deserves a trillion-dollar payout — especially one she claims has erased billions in shareholder value and driven customers away.

Take Back Tesla recently launched an online platform allowing members of the public to petition shareholders directly to reject the compensation package.

During Musk’s time in government, Tesla’s vehicle sales fell sharply. Musk, who reportedly donated $227 million to Trump’s reelection campaign, briefly served as DOGE director, where labor unions say he weakened worker protections and caused widespread disruption without delivering meaningful savings. Although Musk later left the administration after a public dispute with Trump, labor leaders argue he used his position to benefit his private companies and suppress competition.

Communications Workers of America President Claude Cummings Jr. cited a whistleblower complaint alleging that DOGE engineers aligned with Musk accessed sensitive Department of Labor data that could benefit Musk-owned companies like Starlink.

Musk has also faced criticism for supporting a far-right political party in Germany and for an alleged Nazi-style salute at Trump’s inauguration — an accusation he denies. These controversies sparked nationwide protests and consumer boycotts targeting Tesla, including its Cybertruck.

During the October earnings call, Tesla reported profits had dropped nearly 40 percent. While the company blamed $400 million in losses on Trump-era tariffs, reporting suggests Tesla also lowered vehicle prices in an effort to stimulate demand.

Despite these struggles, Tesla board members argued that Musk’s presence is critical to attracting elite engineering talent. Nevertheless, major proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis both recommended that shareholders vote against the compensation plan, warning that it locks Tesla into extreme pay commitments and limits future flexibility.

Musk dismissed these firms during the call, labeling them “corporate terrorists.”

As Tesla approaches its pivotal shareholder vote, the debate highlights broader concerns about executive power, corporate governance, and the growing influence of billionaires over emerging technologies — concerns that show no sign of fading.