RM Elon Musk’s “Unusual” Year in 2025

2025 proved to be a year of intense turbulence for both Tesla and its CEO, Elon Musk. From wild fluctuations in Tesla’s stock price to deeper involvement in U.S. politics, controversies over his massive compensation package, and crucial developments in his self-driving car ambitions, Musk’s year was far from ordinary. Below are three key events that shaped his “extraordinary” year:

Elon Musk’s Political Involvement and Its Impact on Tesla

Musk made headlines early in 2025 with his outspoken support for President Donald Trump’s re-election campaign, contributing over $100 million of his personal fortune. This close relationship with Trump granted Musk significant influence in the White House, even placing him at the helm of the “Department of Government Efficiency” (DOGE) initiative. However, this partnership quickly soured.

Musk openly criticized a major spending bill proposed by Trump, particularly because it stripped away electric vehicle tax incentives and emissions regulations—critical sources of revenue for Tesla. The resulting political friction sent Tesla’s stock into a downward spiral, pulling SpaceX into the political crossfire as well.

In the end, the two sides reached a temporary ceasefire when Musk’s candidate for NASA’s leadership was re-nominated. Despite this truce, investors remained wary, uncertain about when Musk would stir up another political storm with his next controversial statement.

Musk’s “Billion Dollar” Compensation Package

In November 2025, Tesla’s shareholders approved an unprecedented new compensation deal for Musk, potentially worth up to $1 trillion if he meets all performance targets. Over 75% of shareholders voted in favor, despite vocal opposition from large entities like Norway’s sovereign wealth fund and CALPERS.

This compensation package is tied to ambitious goals: Tesla must deliver its 20 millionth car, launch 1 million robotaxis, sell 1 million Optimus robots, and achieve an EBITDA of $400 billion. Even more ambitious is the requirement for Tesla’s market capitalization to hit $8.5 trillion, compared to its current value of about $1.5 trillion.

Despite these lofty objectives, consulting firms pointed out that the Tesla board retains the flexibility to pay Musk even if he doesn’t meet all the targets. This has reignited debates about Tesla’s corporate governance and the fairness of the deal.

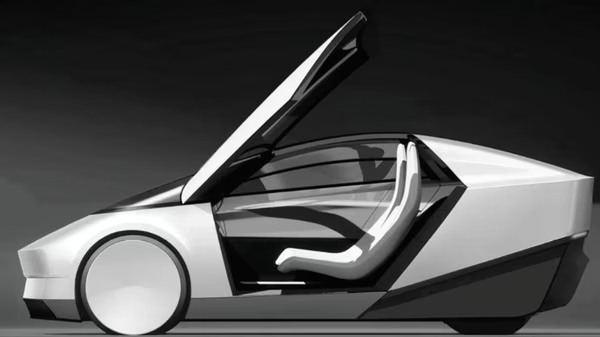

Are Robotaxis the Future of Tesla?

2025 also marked significant progress for Tesla in the self-driving car sector. The company expanded its robotaxi trial program in Austin, Texas, and by mid-December, Musk confirmed that Tesla was testing fully autonomous vehicles without a safety driver onboard.

Although the technology still faces challenges and cautious deployment, many analysts remain optimistic. Several forecasts suggest that 2026 could be a breakthrough year for autonomous driving technology, with robotaxis and fully self-driving cars becoming the key growth drivers for Tesla.

Musk even claimed that Tesla’s fleet of robotaxi Model Ys in Austin could soon operate fully autonomously in the very near future. For investors, this remains a high-stakes gamble: if successful, Tesla could enter a new phase of growth; if it fails, current expectations could be severely tested.