RM China’s Rising Dominance in Humanoid Robots: A Challenge to America’s Tech Leadership

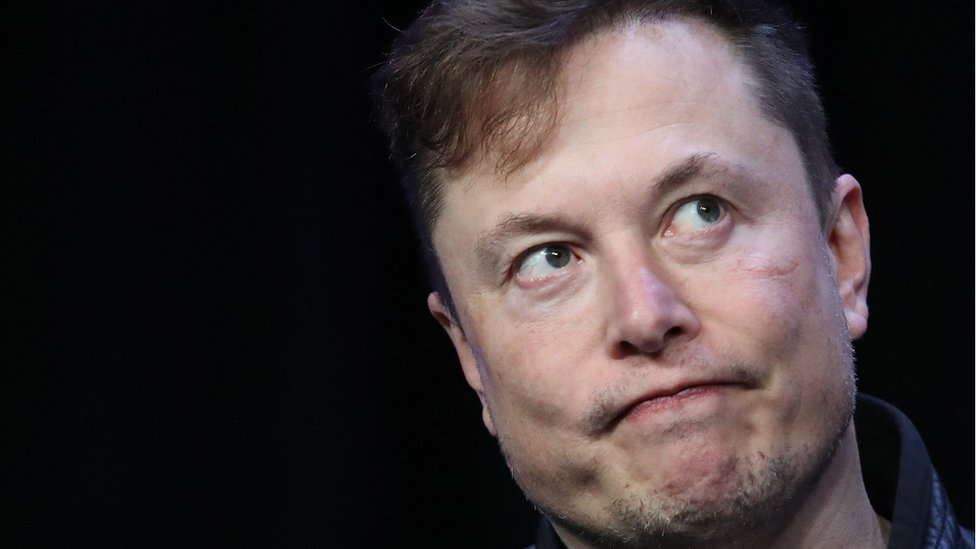

At the 2025 Consumer Electronics Show (CES) in Las Vegas, one of Elon Musk’s main concerns about the future of humanoid robots was clearly visible: China’s dominance in this rapidly growing sector. Musk had previously expressed his worry that while Tesla’s Optimus robot leads the field in terms of performance, Chinese companies might soon overtake the US, filling ranks 2 through 10 on the global leaderboard. His fears seemed well-founded as Chinese-made humanoid robots were in abundance on the exhibition floor, performing a wide range of tasks—everything from playing table tennis and sweeping floors to practicing Kung Fu.

Back in April 2025, Musk shared his concerns during a conference call, stating, “I’m a little concerned that on the leaderboard, ranks 2 through 10 will be Chinese companies,” according to Bloomberg. This statement highlighted the increasing competitive edge China holds in the field of robotics, a reality made evident at CES, where numerous Chinese robot manufacturers showcased their innovations.

One of the most notable exhibitors was Agibot, a company backed by Tencent, which unveiled its Genie Sim 3.0, a next-generation simulation platform. This platform, based on Nvidia’s Isaac Sim, offers more realistic virtual environments for robot training and testing, reportedly reducing both training time and costs. Agibot, which made its US debut at CES, revealed its plans to expand internationally, targeting labor-shortage markets like Japan and even the US, where robots could eventually be used in promotional or entertainment roles.

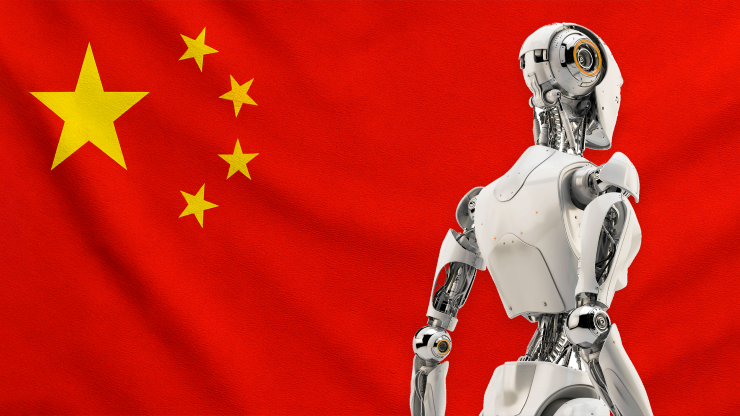

Chinese companies, including Agibot, Unitree, and EngineAI, are leveraging artificial intelligence to create robots capable of learning new tasks autonomously. According to research from Omdia, Chinese manufacturers accounted for the majority of the approximately 13,000 humanoid robots shipped globally in the previous year—far outpacing American companies like Tesla and Figure AI in terms of volume. China’s aggressive push into this sector has placed the country in a strong position as the global market for humanoid robots is expected to soar, with projections of 648 million units by 2050, according to Citigroup.

The cost advantage of Chinese robots is another key factor driving their success. With models like Unitree’s entry-level robot priced at just $6,000 and Agibot’s scaled-down versions around $14,000, Chinese humanoid robots are much more affordable than their Western counterparts. In comparison, Tesla’s Optimus robot is expected to be priced between $20,000 and $30,000, but has not yet reached full-scale production.

Omdia predicts that global shipments of humanoid robots will grow to 2.6 million units by 2035. As AI, dexterous hands, and self-reinforcement learning technologies improve, robots will become increasingly viable for industrial, service, and even household roles. The Chinese government has also prioritized humanoid robots as a disruptive technology, with policies that aim to establish a competitive industrial ecosystem. By 2035, the market for humanoid robots is expected to reach $43 billion.

In conclusion, China’s growing dominance in the humanoid robot market has significant implications for the global tech race. While Tesla and other US companies are working on their own robots, the sheer scale, affordability, and government support of Chinese manufacturers may prove to be a formidable challenge.